# A tibble: 5 × 8

Invoice StockCode Descript…¹ Quant…² InvoiceDate Price Custo…³ Country

<chr> <chr> <chr> <dbl> <dttm> <dbl> <chr> <chr>

1 489434 85048 "15CM CHR… 12 2009-12-01 07:45:00 6.95 13085 United…

2 489434 79323P "PINK CHE… 12 2009-12-01 07:45:00 6.75 13085 United…

3 489434 79323W "WHITE CH… 12 2009-12-01 07:45:00 6.75 13085 United…

4 489434 22041 "RECORD F… 48 2009-12-01 07:45:00 2.1 13085 United…

5 489434 21232 "STRAWBER… 24 2009-12-01 07:45:00 1.25 13085 United…

# … with abbreviated variable names ¹Description, ²Quantity, ³`Customer ID`BTYD Modelling with Stan

Mick Cooney mickcooney@gmail.com

Background

Before I Begin…

This talk is brought to you in association with

Bayesian Mixer

Dublin Data Science

Goals

- Teach Bayes

- Use realistic problem

- Learn BTYD

How hard can it be???

Customer Lifetime Value

UCI Machine Learning Repository

Online Retail II

https://archive-beta.ics.uci.edu/dataset/502/online+retail+ii

Transaction Data

# A tibble: 5 × 22

row_id invoice_id stock…¹ descr…² quant…³ invoice_…⁴ price custo…⁵ country

<chr> <chr> <chr> <chr> <dbl> <date> <dbl> <chr> <chr>

1 ROW0000001 489434 85048 "15CM … 12 2009-12-01 6.95 13085 United…

2 ROW0000002 489434 79323P "PINK … 12 2009-12-01 6.75 13085 United…

3 ROW0000003 489434 79323W "WHITE… 12 2009-12-01 6.75 13085 United…

4 ROW0000004 489434 22041 "RECOR… 48 2009-12-01 2.1 13085 United…

5 ROW0000005 489434 21232 "STRAW… 24 2009-12-01 1.25 13085 United…

# … with 13 more variables: stock_code_upr <chr>, cancellation <lgl>,

# invoice_dttm <dttm>, invoice_month <chr>, invoice_dow <chr>,

# invoice_dom <chr>, invoice_hour <chr>, invoice_minute <chr>,

# invoice_woy <chr>, invoice_ym <chr>, stock_value <dbl>,

# invoice_monthprop <dbl>, exclude <lgl>, and abbreviated variable names

# ¹stock_code, ²description, ³quantity, ⁴invoice_date, ⁵customer_id# A tibble: 5 × 4

tnx_timestamp customer_id invoice_id total_spend

<dttm> <chr> <chr> <dbl>

1 2009-12-01 07:45:00 13085 489434 505.

2 2009-12-01 07:45:59 13085 489435 146.

3 2009-12-01 09:05:59 13078 489436 630.

4 2009-12-01 09:08:00 15362 489437 311.

5 2009-12-01 09:23:59 18102 489438 2286.

RFM Models

Recency

Frequency

Monetary

# A tibble: 5 × 9

customer_id date_most_recent recen…¹ trans…² amount recen…³ frequ…⁴ monet…⁵

<chr> <dttm> <dbl> <dbl> <dbl> <int> <int> <int>

1 12346 2010-06-28 13:53:00 186. 11 373. 2 5 2

2 12347 2010-12-07 14:56:59 24.4 2 1323. 5 2 4

3 12348 2010-12-16 19:08:59 15.2 2 913. 5 2 3

4 12349 2010-10-28 08:23:00 64.7 3 2671. 3 3 5

5 12351 2010-11-29 15:23:00 32.4 1 301. 4 1 2

# … with 1 more variable: rfm_score <dbl>, and abbreviated variable names

# ¹recency_days, ²transaction_count, ³recency_score, ⁴frequency_score,

# ⁵monetary_scoreNot much statistics…

Censored data

Survival analysis?

BTYD Models

Buy Till You Die

Counting Your Customers: Who Are They and What Will They Do Next?

(SMC Paper)

Peter Fader

Bruce Hardie

Statistical distributions of transactions

\[ \begin{eqnarray*} x &=& \text{count of transactions} \\ t_x &=& \text{time from birth to last transaction} \\ T &=& \text{time from birth to observation time} \end{eqnarray*} \]

\[ \text{Data: } (x, t_x, T) \]

P/NBD Models

\[ \begin{eqnarray*} x &\sim& \text{Poisson}(\lambda) \\ \tau &\sim& \text{Exponential}(\mu) \\ \\ \lambda &\sim& \text{Gamma}(\alpha, r) \\ \mu &\sim& \text{Gamma}(s, \beta) \\ \end{eqnarray*} \]

\[ \text{Parameters: } (\alpha, r, s, \beta) \]

BG/NBD Models

\[ \begin{eqnarray*} x &\sim& \text{Poisson}(\lambda) \\ P(\text{alive}, k) &\sim& \text{Geometric}(p, k) \\ \\ \lambda &\sim& \text{Gamma}(\alpha, r) \\ p &\sim& \text{Beta}(a, b) \\ \end{eqnarray*} \]

\[ \text{Parameters: } (\alpha, r, a, b) \]

But what about monetary?

G/G Spend Models

\[ \begin{eqnarray*} v &\sim& \text{Gamma}(p, \nu) \\ \\ p &\sim& \text{Gamma}(q, \gamma) \\ \end{eqnarray*} \]

\[ \text{Parameters: } (\nu, q, \gamma) \]

First Attempts

Pareto NBD Standard Model

Call:

pnbd(clv.data = customer_clvdata, start.params.model = c(r = 0.5,

alpha = 10, s = 1, beta = 20))

Coefficients:

r alpha s beta

0.84195 10.59826 0.05091 175.61767

KKT1: TRUE

KKT2: TRUE

Used Options:

Correlation: FALSE

To Stan!!!

Stan Code

Likelihood Model

\[ \begin{eqnarray*} LL(\lambda, \mu \, | \, x, t_x, T) = x \log \lambda + \log \mu - \log(\lambda + \mu) \\ + \, \text{log_sum_exp}(A, \, B)\\ \\ A = -(\lambda + \mu) \, t_x \;\;\;\; B = \log \lambda - (\lambda + \mu) \, T \end{eqnarray*} \]

Checking sampler transitions treedepth.

Treedepth satisfactory for all transitions.

Checking sampler transitions for divergences.

No divergent transitions found.

Checking E-BFMI - sampler transitions HMC potential energy.

The E-BFMI, 0.01, is below the nominal threshold of 0.30 which suggests that HMC may have trouble exploring the target distribution.

If possible, try to reparameterize the model.

The following parameters had fewer than 0.001 effective draws per transition:

s, beta

Such low values indicate that the effective sample size estimators may be biased high and actual performance may be substantially lower than quoted.

The following parameters had split R-hat greater than 1.05:

s, beta

Such high values indicate incomplete mixing and biased estimation.

You should consider regularizating your model with additional prior information or a more effective parameterization.

Processing complete.

Well that doesn’t look awesome…

Simulation-Based Calibration

- Set values for parameters

- Use statistical model to generate data

- Fit model with model

- Compare fitted values to ‘real’ values

But before we get to that…

Gamma Distribution

Reparameterise

\[ \text{Gamma}(r, \alpha) \rightarrow \text{Gamma}(\mu, c_v) \]

\[ \begin{eqnarray*} \mu &=& \text{ Mean} \\ c_v &=& \text{ Coefficient of Variation} \end{eqnarray*} \]

\[ \begin{eqnarray*} r &=& \frac{1}{c_v^2} \\ \\ \alpha &=& \frac{1}{\mu \, c_v^2} \end{eqnarray*} \]

Use this parameterisation from now on

Models of Synthetic Data

Long Timeframe Data

Checking sampler transitions treedepth.

Treedepth satisfactory for all transitions.

Checking sampler transitions for divergences.

No divergent transitions found.

Checking E-BFMI - sampler transitions HMC potential energy.

E-BFMI satisfactory.

Effective sample size satisfactory.

Split R-hat values satisfactory all parameters.

Processing complete, no problems detected.

Fixed Priors

What if we ignore hierarchy?

Fix priors

Checking sampler transitions treedepth.

Treedepth satisfactory for all transitions.

Checking sampler transitions for divergences.

No divergent transitions found.

Checking E-BFMI - sampler transitions HMC potential energy.

E-BFMI satisfactory.

Effective sample size satisfactory.

Split R-hat values satisfactory all parameters.

Processing complete, no problems detected.

Hierarchical-Means Model

- Fix both \(c_v\) values

- Hierarchical priors for \(E(\lambda)\) and \(E(\mu)\).

model {

// model the hyper-prior

lambda_mn ~ lognormal(lambda_mn_p1, lambda_mn_p2);

mu_mn ~ lognormal(mu_mn_p1, mu_mn_p2);

// setting priors

lambda ~ gamma(r, alpha);

mu ~ gamma(s, beta);

target += calculate_pnbd_loglik(n, lambda, mu, x, t_x, T_cal);

}Checking sampler transitions treedepth.

Treedepth satisfactory for all transitions.

Checking sampler transitions for divergences.

No divergent transitions found.

Checking E-BFMI - sampler transitions HMC potential energy.

E-BFMI satisfactory.

Effective sample size satisfactory.

Split R-hat values satisfactory all parameters.

Processing complete, no problems detected.

Models on Real-World Data

Fixed Prior Model

Checking sampler transitions treedepth.

Treedepth satisfactory for all transitions.

Checking sampler transitions for divergences.

No divergent transitions found.

Checking E-BFMI - sampler transitions HMC potential energy.

E-BFMI satisfactory.

Effective sample size satisfactory.

Split R-hat values satisfactory all parameters.

Processing complete, no problems detected.

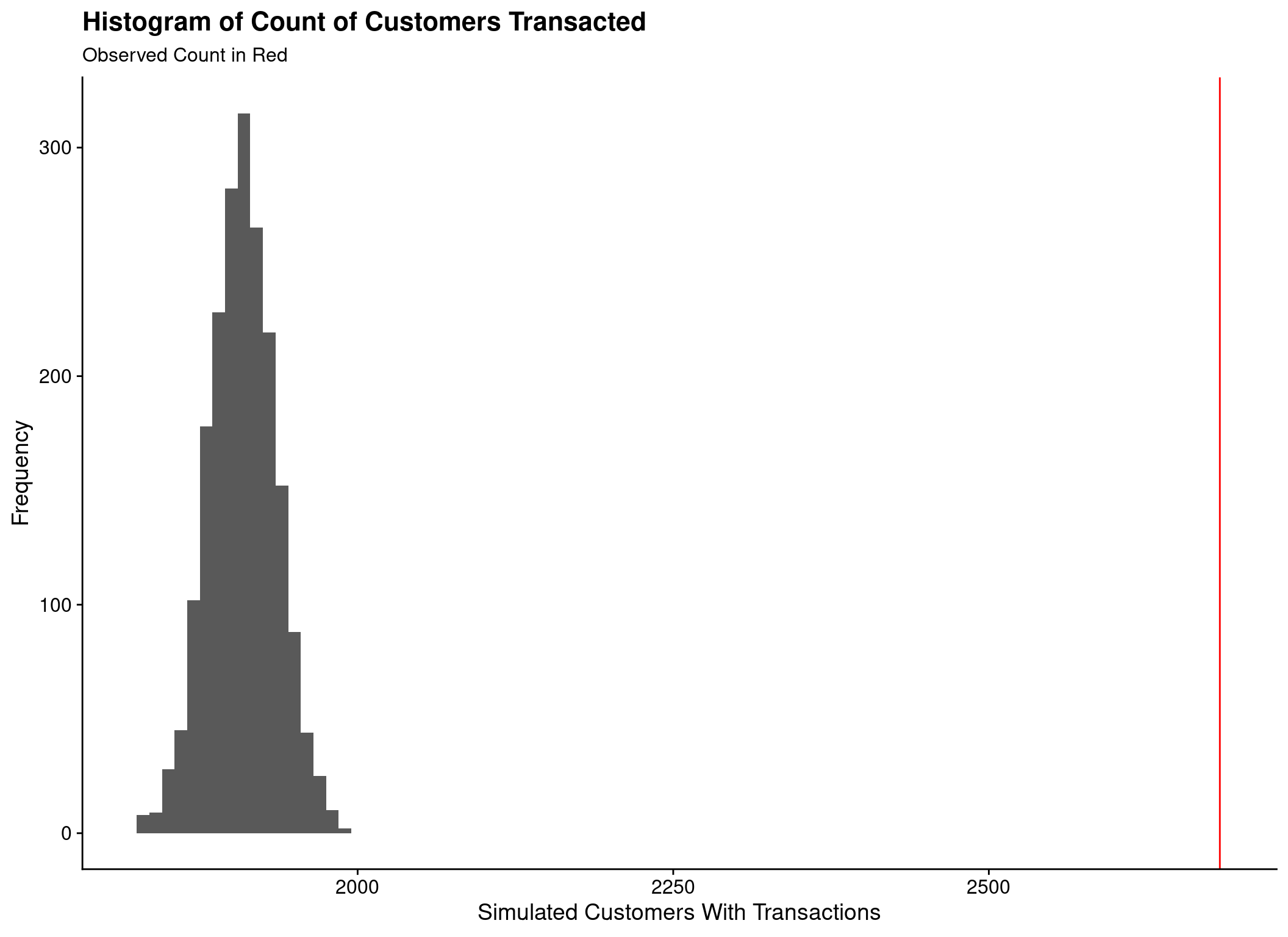

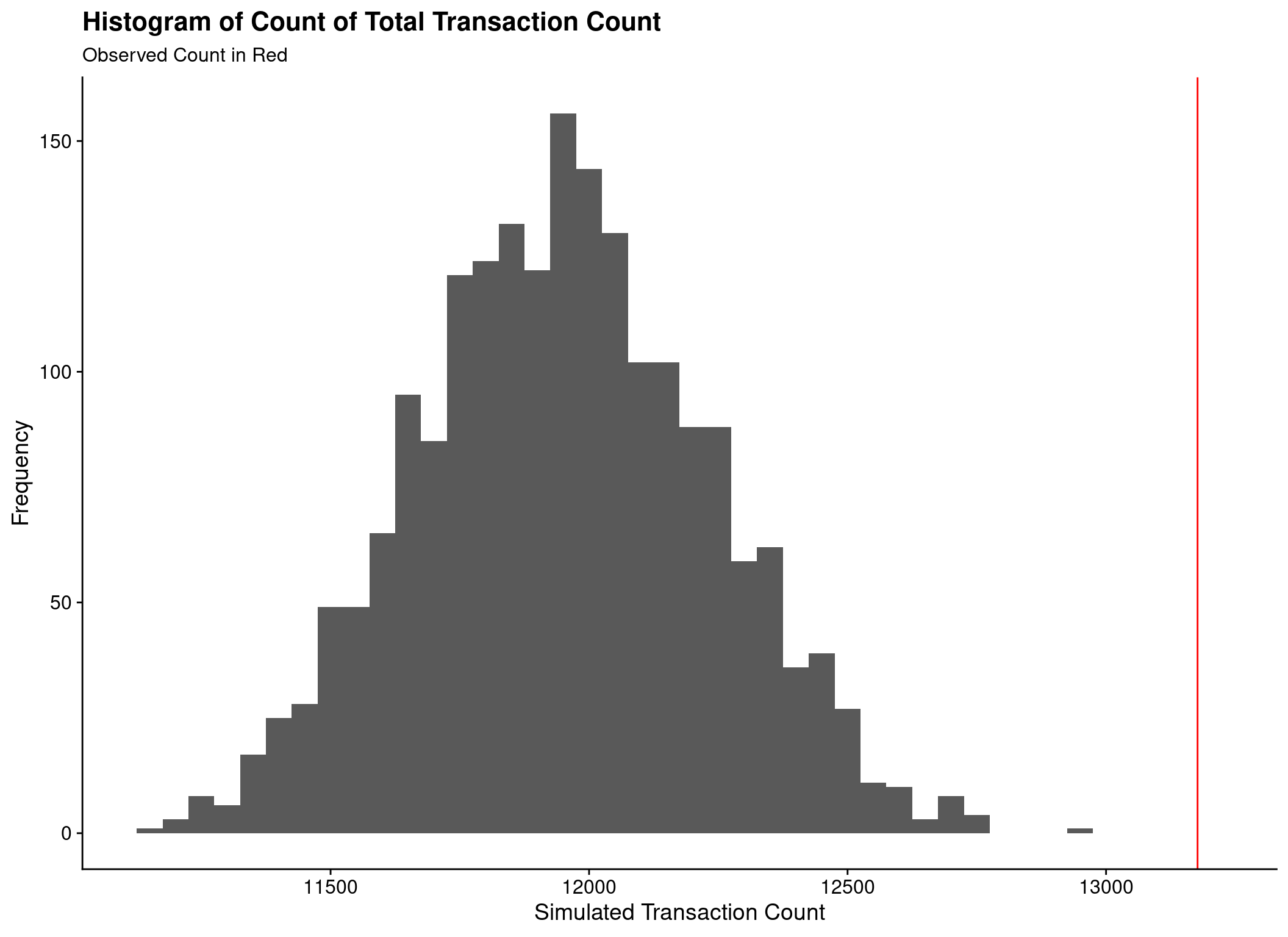

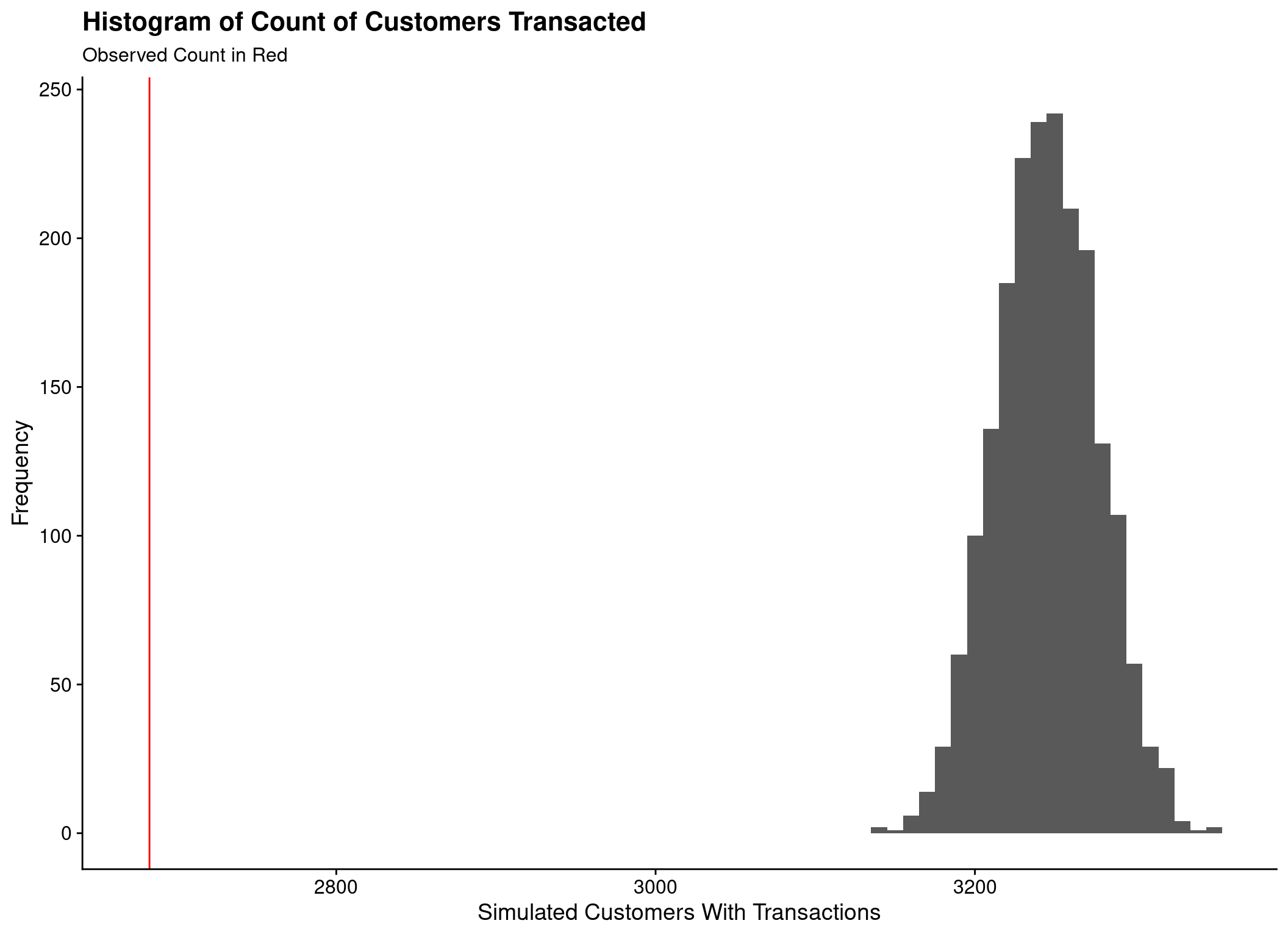

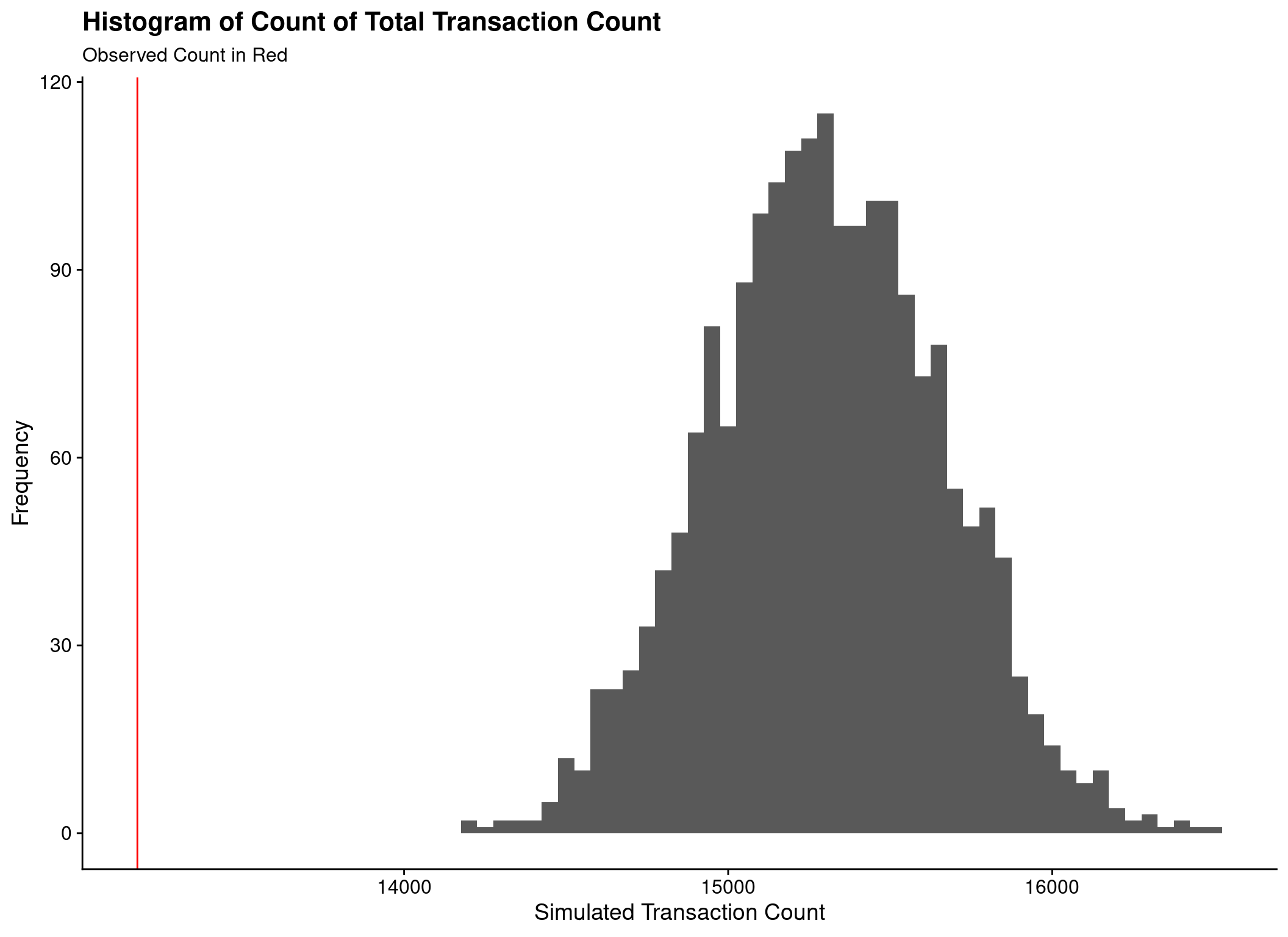

Cannot compare to ‘real’ values

- Count of customers transacting

- Count of all transactions

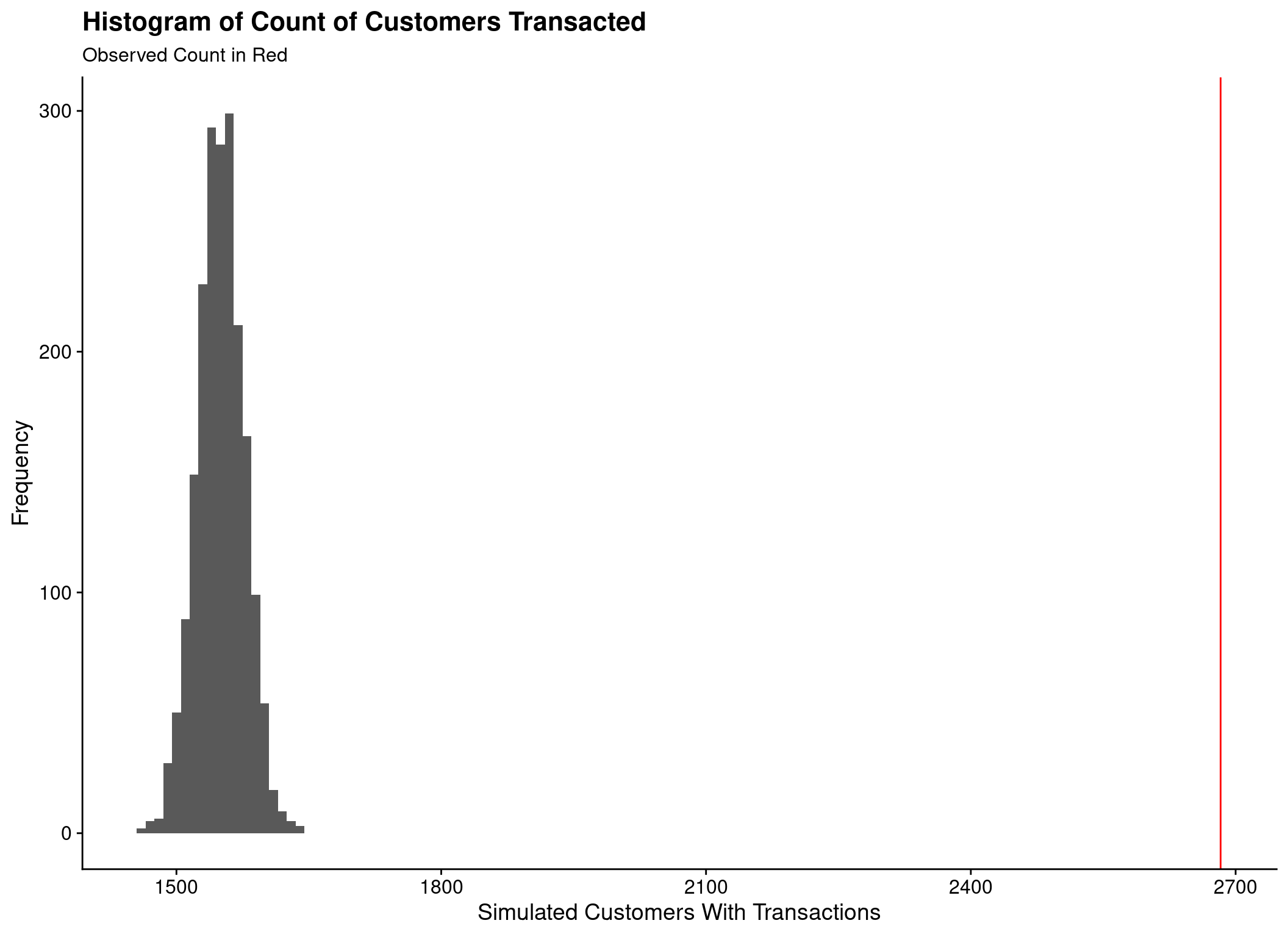

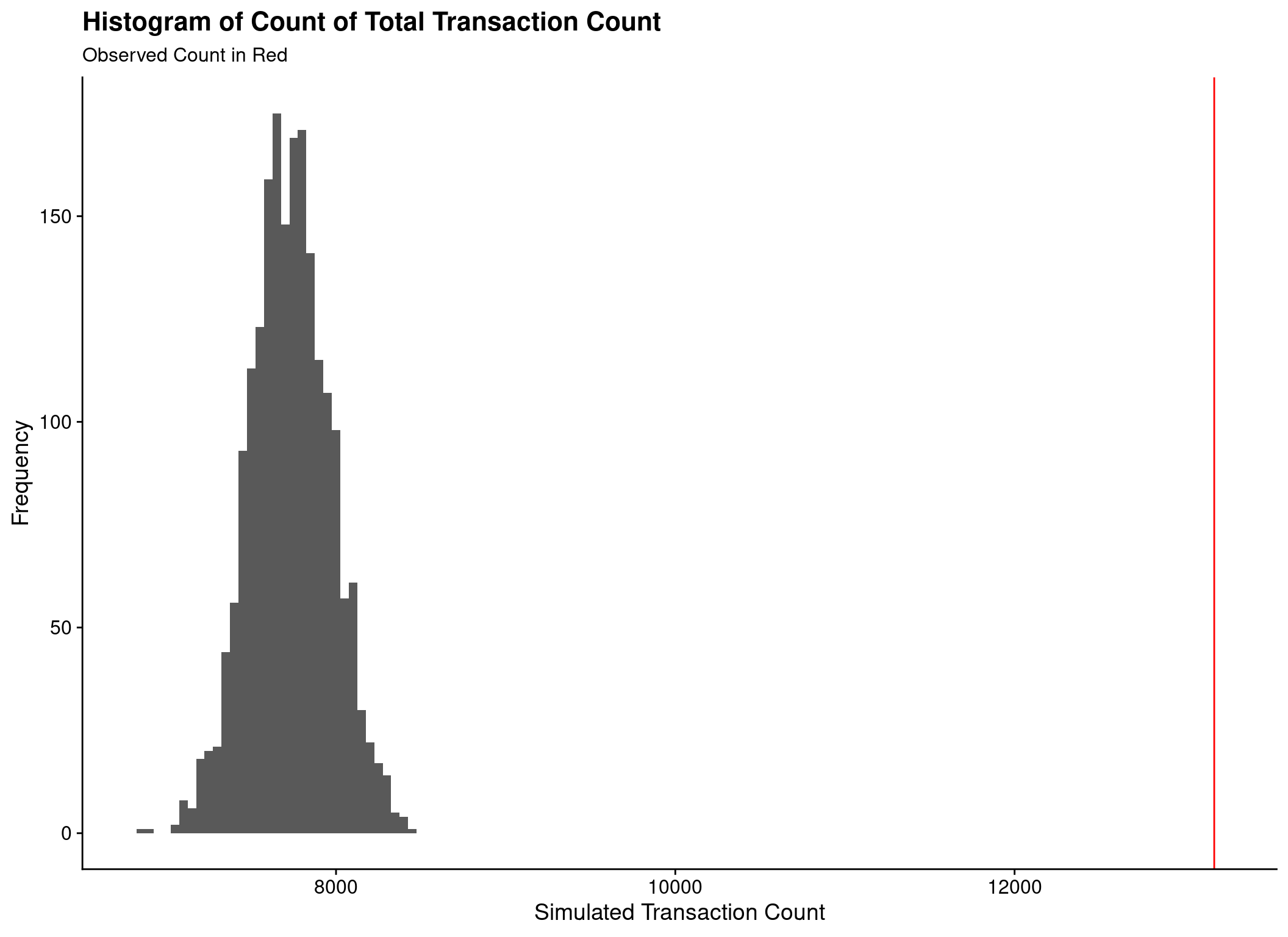

Hierarchical-Lambda Model

BG/NBD Model

No explicit lifetime model

Chance of lapsing, \(p\), after transaction

Conclusion

Lessons Learned

Workshop

Bad Idea

Better to use brms / rstanarm

Useful approach \(\rightarrow\) Problem worth solving

BTYD Models

Re-do Data Generation

Pay attention to seasonality

Add monetary modelling

Thank You!

This talk…

https://github.com/kaybenleroll/data_workshops/talk_bm_btydbayes_202211

Workshop…

https://github.com/kaybenleroll/data_workshops/ws_clvbayes_202201